In trading, the term “edge” refers to a strategy or set of techniques that gives a trader a statistical advantage over the market. For many traders, especially those managing smaller accounts, the edge they’ve developed works effectively and produces consistent profits. However, as traders grow their accounts or take on more capital, they often find that their once-reliable edge begins to erode.

Let’s explore the reasons why an increase in trading capital can reduce or even eliminate your edge and what you can do to adapt.

1. Liquidity Constraints

One of the primary reasons for losing your edge with larger funds is liquidity. Liquidity refers to how easily an asset can be bought or sold without significantly affecting its price. When you are trading with a small account, your buy or sell orders often go unnoticed because they don’t make much of an impact on the overall market.

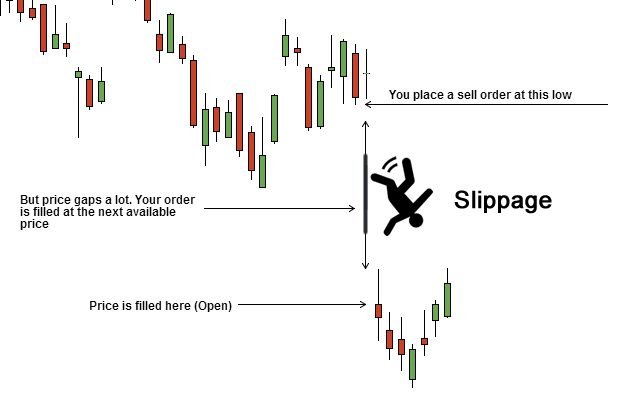

However, with more capital comes the need for larger positions. In less liquid markets, such as small-cap stocks, certain commodities, or exotic forex pairs, placing large orders can lead to “slippage.” This occurs when your order is too large to be filled at the expected price, causing the price to move against you as your trade is executed. Essentially, your own trades move the market, reducing the effectiveness of your strategy and eating into your profits.

Example: If you’re trading a lightly traded stock with a daily volume of 100,000 shares, buying or selling 10,000 shares will likely move the price. This means you can’t easily get in or out of positions without pushing the price against you.

2. Diminishing Returns of Small-Scale Strategies

Certain trading strategies work exceptionally well with smaller accounts but lose effectiveness as the account grows. For example, scalping (where traders make quick trades to capture small price movements) can be very profitable with small funds. However, once your capital increases, capturing these small price movements no longer generates enough return relative to the risk.

With larger capital, small price moves might not be enough to justify the risk of putting a substantial amount of money on the line. This can lead traders to chase bigger moves, which in turn might increase their exposure to volatility, risk, and larger drawdowns.

Example: If you’re scalping for 0.1% gains on a $10,000 account, a $10 gain might be fine. But when your account grows to $1 million, making $100 on that same 0.1% move no longer seems worth the effort, especially when the risk of significant loss grows with larger positions.

3. Execution Slippage

Slippage is a problem that becomes more pronounced as you trade larger amounts of capital. When you place a large trade, especially in a fast-moving market, you often don’t get filled at the exact price you wanted. Instead, you end up with a worse price due to slippage. This can happen on both entry and exit, making it more difficult to manage trades effectively.

Moreover, executing large orders may require multiple partial fills at different prices, further eating into your profits. The more capital you’re working with, the greater the potential for slippage, which can degrade the profitability of previously reliable strategies.

Example: Suppose you want to buy 10,000 shares at $10 each, but the market moves quickly, and your order is only partially filled at $10. The rest of your order gets filled at $10.05, and your effective price becomes $10.03, eroding your profit margin.

4. Market Visibility and Front-Running

With larger funds, your trades become more visible to the broader market. In some cases, other market participants, including institutions, may detect your large trades and adjust their strategies accordingly. In high-frequency trading environments, algorithms can recognize large orders and move prices against you in a practice known as front-running.

This can be particularly problematic in illiquid markets or when trading large blocks of assets. As your trades become more visible, other traders may step in to capitalize on your moves, diminishing the effectiveness of your strategy.

Example: If you place a large buy order in a low-volume market, algorithms might identify this as a signal of demand and push the price up before your order is fully filled, forcing you to buy at a higher price.

5. Increased Regulatory Scrutiny

As your trading capital grows, you may be subject to increased regulatory requirements and restrictions. This is particularly true for hedge funds, professional traders, or institutional investors managing substantial sums of money. With more stringent regulations come additional costs, compliance requirements, and potential limits on the types of assets or strategies you can employ.

These regulations can limit your ability to trade in the same way you did with smaller accounts, thus diminishing your edge.

6. Increased Competition

With larger funds, you’re competing with institutional investors and high-frequency trading firms that have access to advanced algorithms, technologies, and market data. Their ability to process information and execute trades quickly can erode your edge, particularly in highly competitive markets.

7. Psychological Pressure

Managing a larger amount of capital can introduce psychological stress. The fear of losing significant sums can lead to over-cautious trading or emotional decision-making, which may deviate from your original strategy.

8. Overtrading

With more capital, there may be a temptation to trade more frequently, seeking to maximize returns. This can lead to overtrading, where traders take on more risk and incur higher transaction costs, ultimately diminishing their edge.

9. Complexity of Strategies

Scaling up often requires more complex strategies that can be harder to manage. The increased complexity can lead to mistakes or oversight in trade execution, reducing the overall effectiveness of the strategy.

10. Market Impact Costs

Large trades can cause market impact costs, where the act of buying or selling pushes the price away from the desired level. This can significantly reduce profitability, especially in less liquid markets.

11. Higher Transaction Costs

With larger trades, transaction costs (such as commissions and spreads) become a more significant factor. These costs can erode profits, especially if the strategy relies on small price movements.

12. Strategy Fatigue

A strategy that worked well in the past may become less effective as more traders recognize and exploit it. As your capital increases, you may find that what once provided an edge is now widely adopted, leading to reduced effectiveness.

How to Adapt and Maintain Your Edge

Shift to More Liquid Markets: Focus on highly liquid assets, such as major forex pairs or large-cap stocks, to minimize the impact of your trades.

Use Algorithmic Trading: Algorithms can help manage large orders by breaking them down into smaller chunks, reducing slippage and market impact.

Employ Multi-Timeframe Strategies: Consider strategies that take advantage of longer timeframes, reducing the need to chase small price movements.

Diversify Across Strategies and Assets: Spread your risk by employing multiple strategies across various markets, ensuring that your overall exposure is managed effectively.

Refine Risk Management: Adjust position sizing and implement strict risk management practices to protect capital and reduce psychological pressure.

Leverage Technology: Use trading platforms and tools that provide advanced analytics and real-time data to make informed decisions.

Stay Informed: Continuously educate yourself about market trends, regulatory changes, and evolving strategies to maintain your edge.

Practice Discipline: Stick to your trading plan, avoiding emotional decisions that can lead to impulsive trading behavior.

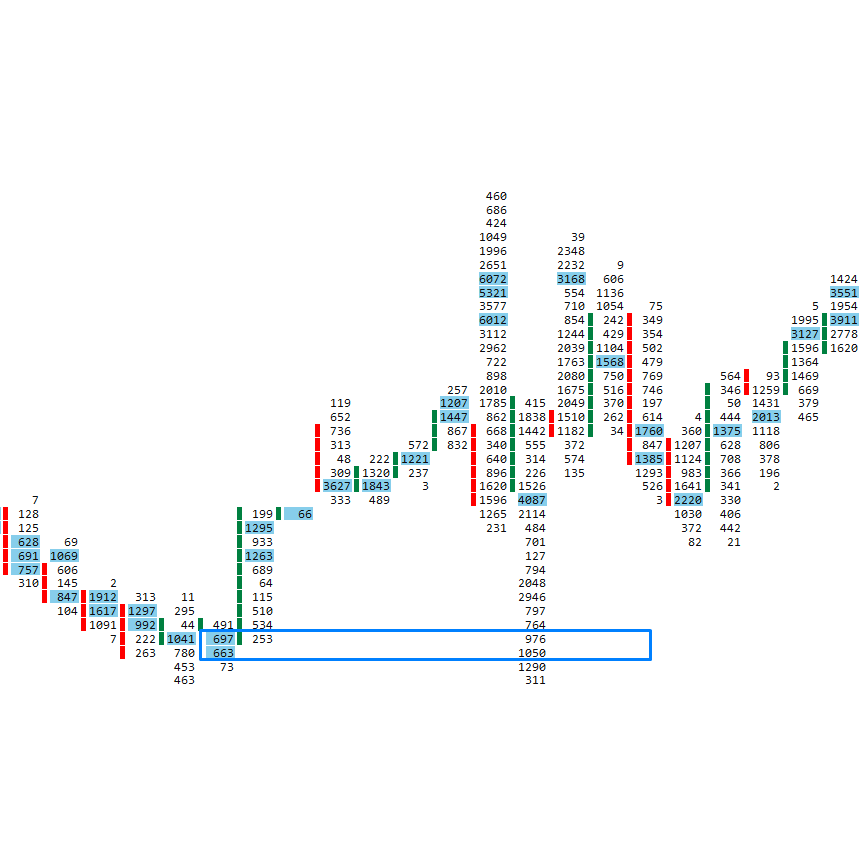

Backtest Pro Trading Strategy Optimization

BacktestPro offers a specialized Trading Strategy Optimization service tailored for traders seeking to refine and enhance their trading strategies. Through this service, traders can leverage historical market data to backtest and fine-tune their strategies, ensuring they perform optimally under different market conditions. With a focus on precision and efficiency, BacktestPro empowers traders to reduce risk, improve decision-making, and maximize profitability by offering insights that drive smarter, data-backed trading strategies. Whether you’re fine-tuning an existing approach or developing new strategies, BacktestPro helps you achieve superior trading outcomes.

Conclusion

Losing your trading edge as capital increases is a common challenge faced by many traders. Factors such as liquidity constraints, psychological pressure, increased competition, and market impact costs can all contribute to this phenomenon. However, by understanding these challenges and adapting your strategies, you can maintain profitability and continue succeeding in the markets. Recognizing that growing capital requires a refined approach is key to long-term trading success.