Three Powerful Strategies

The Market Gap EA offers traders a suite of comprehensive gap trading strategies, each tailored to meet diverse trading preferences and objectives. These three powerful strategies provide traders with the flexibility to capitalize on market gaps with precision and efficacy.

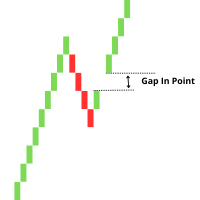

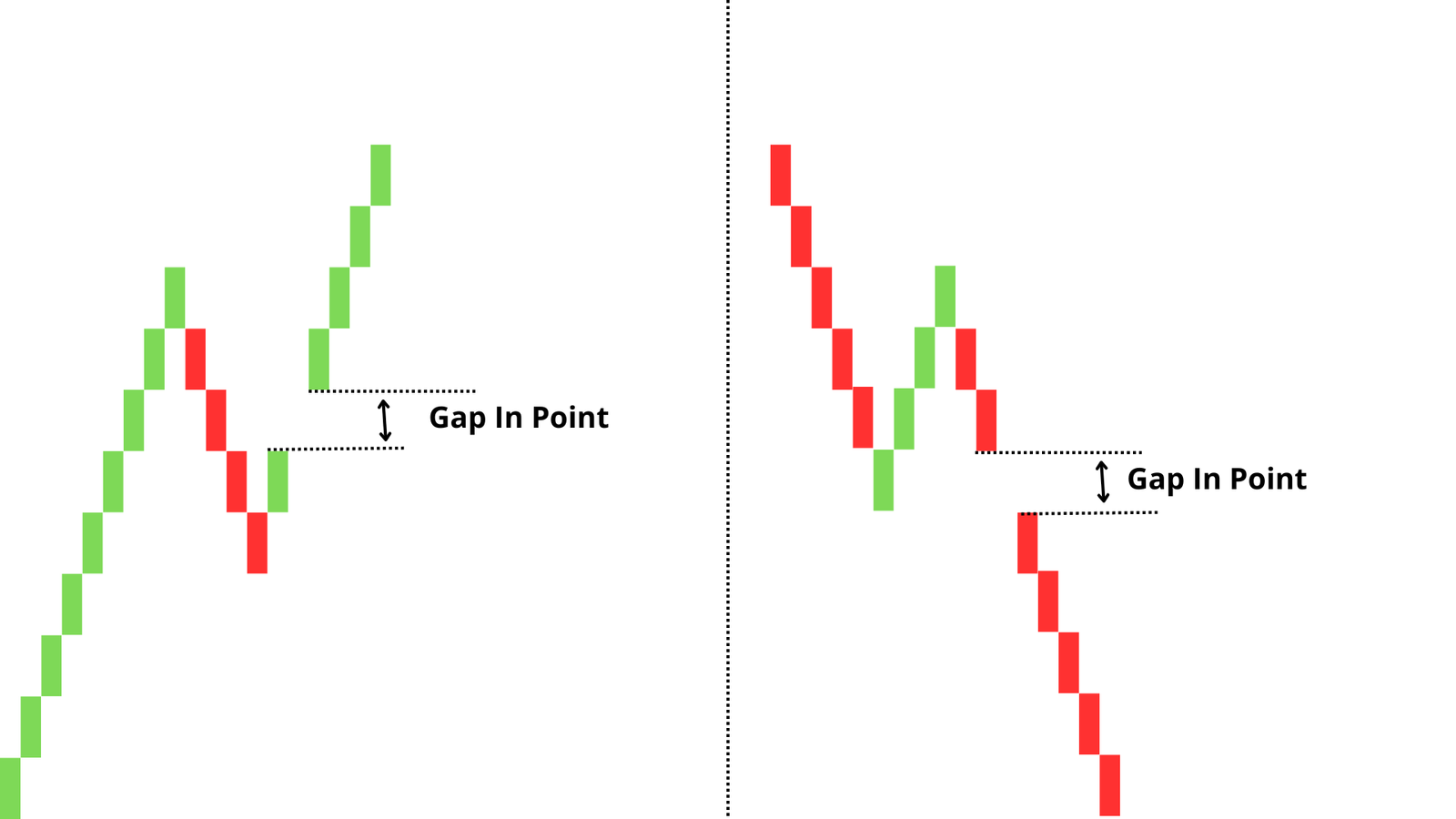

Firstly, traders can opt to trade all gaps, an approach that ensures no opportunity goes unnoticed. This strategy is particularly advantageous in highly volatile markets where gaps occur frequently, allowing traders to capture numerous potential profit opportunities. By trading every gap, traders can leverage the inherent volatility of the market, benefiting from both minor price corrections and significant price movements.

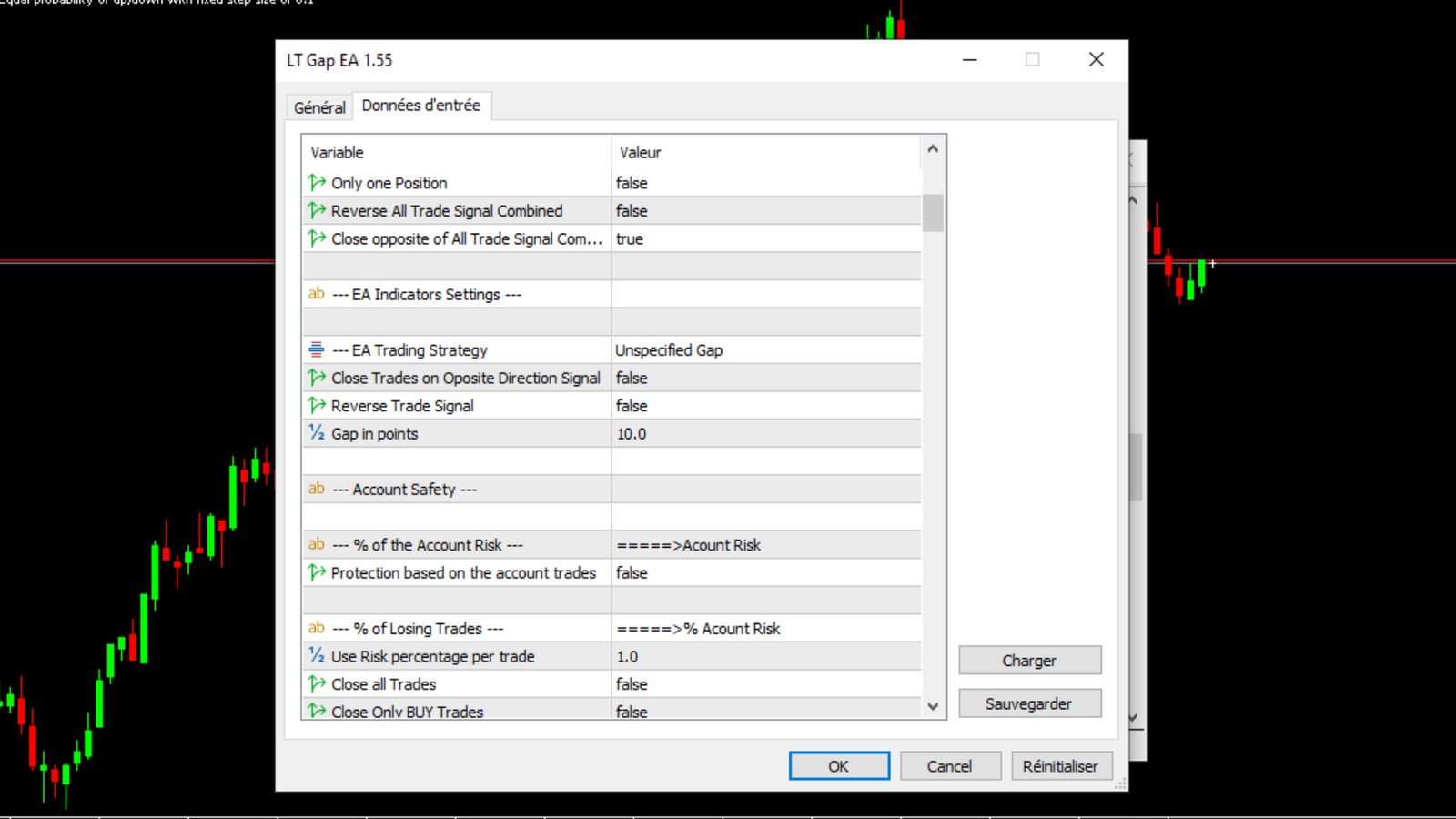

Secondly, the strategy of focusing on gaps that meet predefined minimum criteria is designed for traders looking for higher probability trades. This method filters out minor gaps that might not yield substantial returns, thereby concentrating on those with a greater potential for profitability. By implementing this strategy, traders can enhance their risk management approach, as it allows them to execute trades backed by robust gap criteria, thereby potentially increasing their success rates.

The third strategy revolves around executing trades exclusively when gap distances align with specific predefined values. This precision-focused approach is ideal for traders who prefer methodical and systematic trading. By setting exact gap distance parameters, traders can ensure they enter positions only when market conditions perfectly match their trading plan. This targeted strategy can help in reducing unnecessary trades, thereby optimizing resource allocation and potentially boosting overall trading performance.

In essence, each of these strategies is imbued with unique features and advantages, enabling traders to fine-tune their approach to market gaps. Whether opting to trade all gaps, select gaps based on predefined criteria, or pinpointing trades with specific gap distances, the Market Gap EA provides the tools necessary to maximize trading potential and profitability.

“`

Key Features and Customization Options

The Market Gap EA offers a comprehensive suite of features designed to cater to the diverse needs of traders in the dynamic world of market gap trading. One of the primary aspects is the ability to select between normal or custom symbols, providing traders with the flexibility to operate on their preferred instruments. By offering a range of symbols, the EA ensures that traders can maintain a focus on their preferred markets, contributing to a more personalized trading experience.

Incorporating virtual balances, the Market Gap EA allows for simulated trading, which is an invaluable tool for testing strategies without risking actual capital. Traders can iterate and refine their approaches before transitioning to live trading. The ability to specify trade directions further enhances customization, enabling traders to set parameters for long, short, or bi-directional trades according to their strategic outlook.

The customization doesn’t stop there—closing trades in response to opposite signals ensures adaptive risk management. This feature supports decision-making by automatically responding to changing market conditions, which can crucially protect a trader’s position. Lot sizing options, another critical feature, allow traders to define the scale of their trades, ensuring alignment with their overall risk management strategy.

With account and symbol-specific risk management strategies, the EA provides granularity in risk control. Traders can ensure that their exposures are precisely managed across different accounts and trading symbols. End-of-day trade closure preferences offer flexibility to wind down positions as needed, enabling traders to mitigate overnight risks effectively.

The Market Gap EA is equipped with time filters for specific trading sessions, permitting trades within predetermined windows that match the trader’s operational hours. This is particularly useful for those seeking to exploit market gaps that frequently occur at specific times of the day. Both simple and advanced trailing stop options grant traders the ability to secure profits as the market moves favorably, ensuring gains are locked in while allowing for continued participation in profitable trends.

Lastly, the EA’s advanced filtering capabilities significantly enhance trade accuracy. By incorporating criteria like volume, news events, super trends, and moving averages into trade decisions, traders can filter out less promising opportunities. This leads to a more streamlined and effective trading process, ultimately aiming to yield more consistent and reliable trading results.

2 reviews for Market Gap EA

There are no reviews yet.